wyoming tax rate sales

Download all Wyoming sales tax rates by zip code. The Cody Sales Tax is collected by the merchant on all.

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Groceries are exempt from the Johnson County and Wyoming state.

. Simplify Wyoming sales tax compliance. The minimum combined 2022 sales tax rate for Wyoming Ohio is. Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2There are a total of 105 local tax jurisdictions.

This interactive sales tax map map of Wyoming shows how local sales tax rates vary across Wyomings 23 counties. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. Wyoming has a 4 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1472 on top of the state tax.

Prescription drugs and groceries are exempt from sales tax. While many other states allow counties and other localities to collect a local option sales tax Wyoming does not permit local sales taxes to be collected. 180 rows Wyoming has state sales tax of 4 and allows local governments to collect a local.

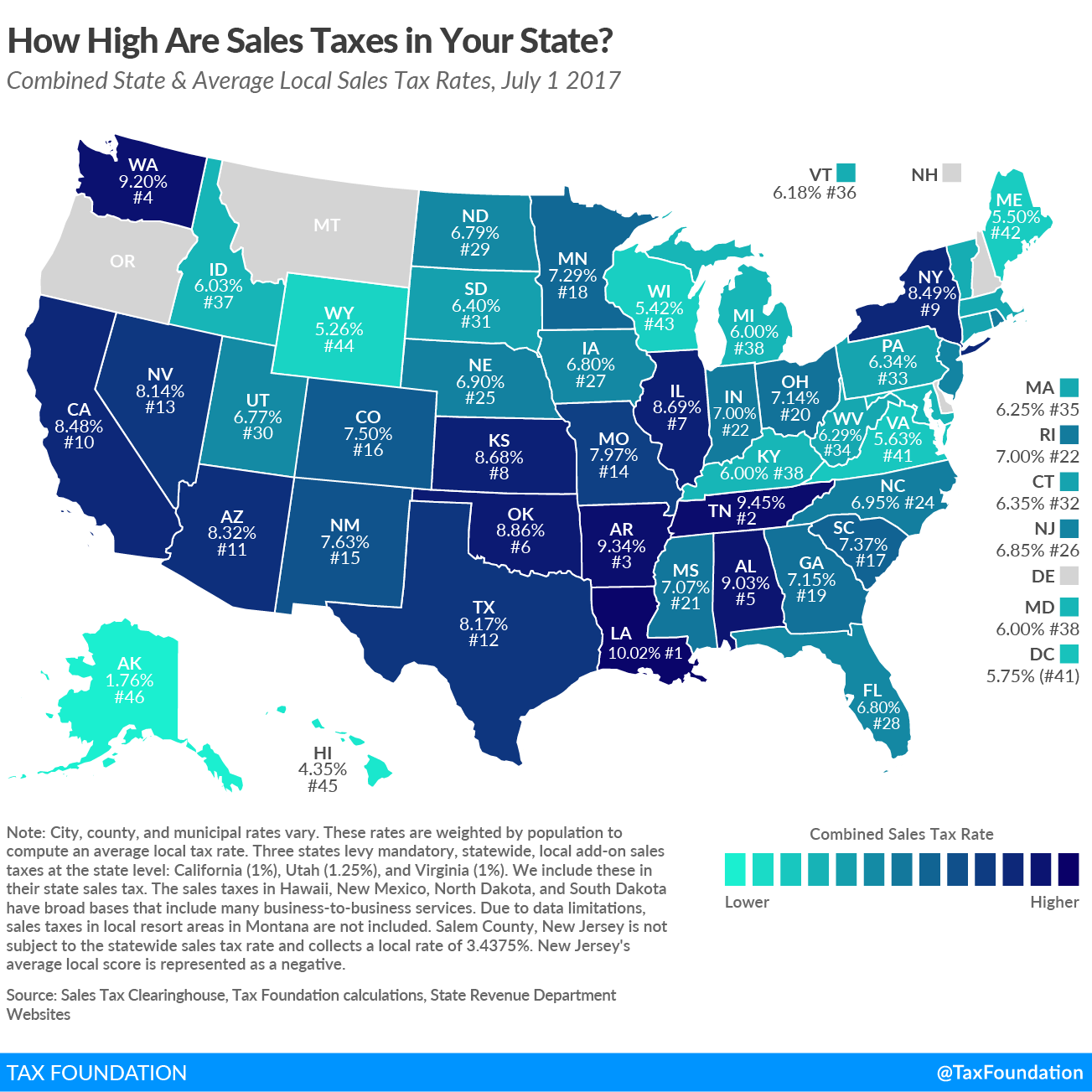

The Wyoming WY state sales tax rate is currently 4. Colorado has the lowest sales tax at 29 while California has the highest at 725. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

With local taxes the total sales tax. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. The current total local sales tax rate in Wyoming WY is 6000.

Sales Use Tax Rate Charts. This is the total of state county and city sales tax rates. Some rates might be.

State wide sales tax is 4. The County sales tax rate is. See the publications section for more information.

The Michigan sales tax rate is currently. The Lander Wyoming sales tax is 400 the same as the Wyoming state sales tax. Five states have no sales tax.

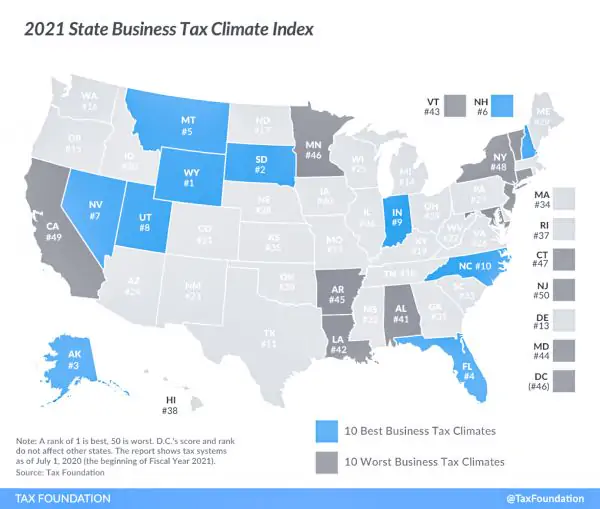

The December 2020 total. Wyomings tax system ranks 1st overall on our 2022 State Business Tax Climate Index. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 2.

The Cody Wyoming sales tax is 400 the same as the Wyoming state sales tax. Cheyenne Burns Carpenter Fe Warren Afb Granite Canon Hillsdale Meriden and Albin. This means that depending on your location within Wyoming the total tax you pay can be significantly higher than the 4 state sales tax.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Wyoming local counties cities and special taxation. Tax rate charts are only updated as changes in rates occur. 31 rows The state sales tax rate in Wyoming is 4000.

Wyomings sales tax rates for commonly exempted categories are listed below. Groceries and prescription drugs are exempt from the Wyoming sales tax. The Johnson County Wyoming sales tax is 500 consisting of 400 Wyoming state sales tax and 100 Johnson County local sales taxesThe local sales tax consists of a 100 county sales tax.

The Johnson County Sales Tax is collected by the merchant on all qualifying sales made within Johnson County. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. The County sales tax rate is.

Wyoming Sales Tax Rate The sales tax rate in Wyoming is 4. While many other states allow counties and other localities to collect a local option sales tax Wyoming does not permit local sales taxes to be collected. Click on any county for detailed sales tax rates or see a full list of Wyoming counties here.

The total tax rate might be as. Depending on local municipalities the total tax rate can be as high as 6. The state sales tax rate in Wyoming is 4 but you can customize this table as needed to reflect your applicable local sales tax rate.

How to Register for Wyoming Sales Tax. Look up 2021 Wyoming sales tax rates in an easy to navigate table listed by county and city. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4.

In Wyoming acquire a sellers permit by following the revenue departments detailed instructions for registration. The Ohio sales tax rate is currently. Lowered from 6 to 5.

The minimum combined 2022 sales tax rate for Wyoming Michigan is. The use tax is the same rate as the tax rate of the county where the purchaser resides. Counties and cities can charge an additional local sales tax of up to 2 for a.

Raised from 5 to 6. 36 rows The current state sales tax rate in Wyoming WY is 4. The Wyoming sales tax rate is.

This is the total of state county and city sales tax rates. The Wyoming sales tax rate is. Free sales tax calculator tool to estimate total amounts.

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

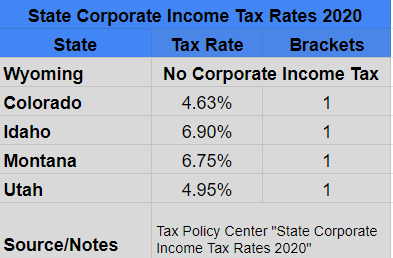

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Ranking State And Local Sales Taxes Tax Foundation

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

State Corporate Income Tax Rates And Brackets Tax Foundation

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Wyoming Sales Tax Rates By City County 2022

When Did Your State Adopt Its Sales Tax Tax Foundation

The Most And Least Tax Friendly Us States

Sales Tax For Online Or Remote Vendors A Study In Complexity Wyoming Small Business Development Center Network

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog